Futa suta calculator

SUTA rates vary depending on your unemployment claims in different states. Free payroll tax withholding calculator to help with state local and federal tax.

Employer Futa Suta Contributions Understanding Futa Chegg Com

Taxes require accuracy and a small mistake in your calculations can lead to disaster in the future.

. This federal tax helps finance South Dakota Department of Labor Programs such as placement labor market information and training of workers to meet industry needs. Get 247 customer support help when you place a homework help service order with us. During times of high unemployment states may borrow from FUTA funds helping provide benefits to locally unemployed people.

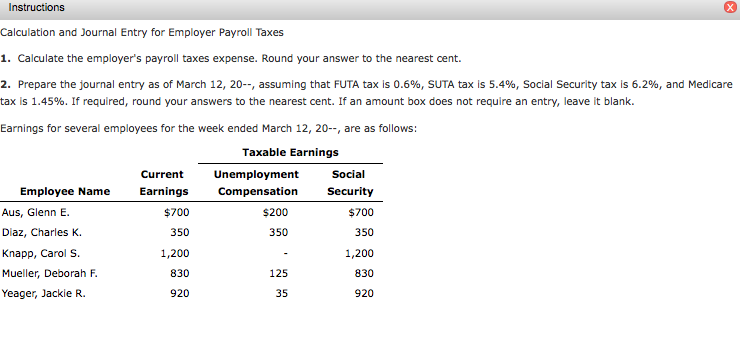

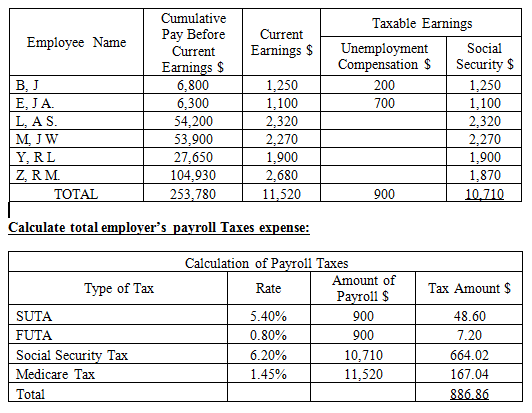

FUTA taxes are administered at the federal level. As an employer youre required to pay taxes for the Federal Insurance Contributions Act FICA which covers Social Security and Medicare and the Federal Unemployment Tax Act FUTA which funds labor related agenciesIn addition you are required to pay state level unemployment taxes SUTA. SutaPct.

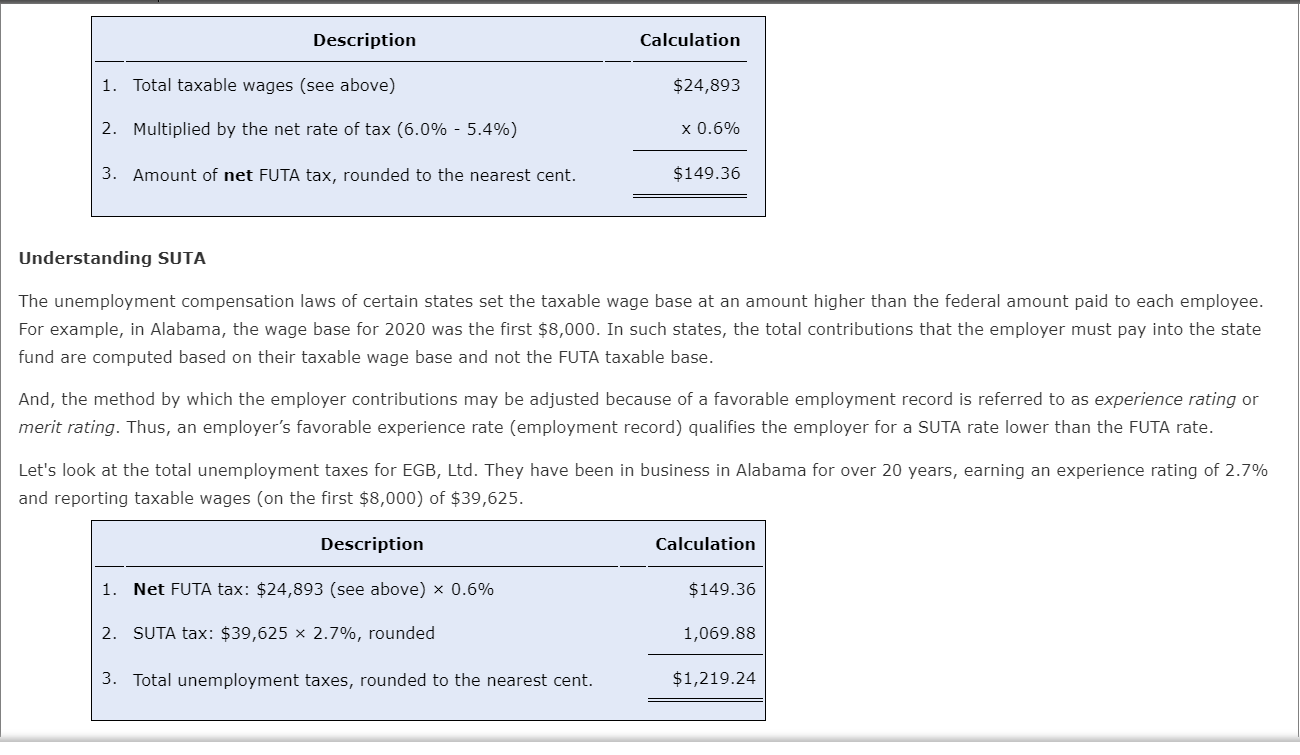

If you are a liable employer under state law you may also be required to pay under the Federal Unemployment Insurance Tax Act FUTA. However you may be able to take a credit of up to 54 against the FUTA tax resulting in a net tax rate of 06. State Unemployment Tax Act SUTA is a tax collected by your state that funds unemployment.

Estimated FUTA Receipts vs. FUTA tax credit. 30 is an estimate.

FUTA payments are due quarterly. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Only the first 50000 of coverage is considered a pretax deduction.

One thing HR professionals generally agree on is that onboarding begins the moment a candidate accepts a job offer and ends when a new employee is fully integrated and performing as expected. The SUTA along with the Federal Unemployment Tax Act FUTA was instituted to help US. This adds up to the total payroll taxes you must pay.

This is especially true if you have a lot of. Note the higher wage rate of 6. 21 months to six years of active service Zone B.

10 to 14 years of service For example say that the US. I really like the simplicity and price of Wagepoint. Although its manageable to calculate payroll taxes manually this isnt recommended.

Form W-3 reports the total wages and tax withholdings for each employee. Workers and to keep the economy afloat. Your credit for 2022 is limited unless you pay all the required contributions for.

State and Federal Monthly Trust Fund Balances. Weve put in some very standard rates for FICA FUTA and SUTA for display purposes. Other taxes such as an employer-paid family leave tax 6.

Theyre used for oversight of state unemployment programs. Six to 10 years of active service Zone C. If youve opted out of your state unemployment insurance for tax reasons your calculation is.

Navigating these payroll taxes can feel very. State Unemployment Taxes SUTA An employees wages are taxable up to an amount called the taxable wage base. The FUTA and SUTA taxes are filed on Form 940 each year.

The business stops paying SUTA tax on Barrys wages once he makes 7000 which happens in the middle of Q2. Eighty years later the SUTA program is still in effect. Salary or 7000 6 FUTA.

Begin your calculation by multiplying the monthly chaplain salary by the number of years for which he is re-enlisting like this. Department of Defense has classified chaplains in Zone B as eligible for SRB. Form 940 is your annual federal unemployment FUTA tax return.

FUTA SUTA unemployment insurance On the other hand SUTA sometimes also referred to as SUI State Unemployment Insurance is calculated in a different way and can change significantly across states. Unemployment insurance FUTA 6 of an employees first 7000 in wages. Enter those two numbers in the GL Rate and WC Rate of the calculator.

Employee 3 has 37100 in eligible FUTA wages but FUTA applies only to the first 7000 of each. Contributions to group-term life insurance are pretax deductions for federal income tax withholding FUTA and FICA. The cost will be displayed for one hour of labor.

There are also state income taxes and state unemployment tax assessment SUTA taxes that can differ by state. Repeat as many times as needed to see the cost of one hour of labor for each labor classification your employees perform. This reflects the self-employment tax and this video is a paycheck city tutorial.

How is FUTA Calculated. These payments are also due quarterly but check with your state to. As Barrys employer you remit 150 of SUTA taxes at the end of March and 60 at.

It also pays the administrative costs of the. At the federal level employers are required to withhold federal income tax Social Security taxes Federal Unemployment Tax FUTA and Medicare taxes for all W-2 employees including remote workers. FutaPct futaBurden SUTA 1.

If you are paying the state unemployment tax then the calculation is. It is extremely helpful to have an accurate time tracking solution so. Unemployment insurance SUTA 5.

The FUTA tax is 60 of your employees FUTA wages. FUTA payments are due quarterly and can result in a fine if not paid on time. Experienced sky-high unemployment rates.

FUTA the federal insurance tax is calculated in a very similar way to state unemployment. When Congress passed the Coronavirus Aid Relief and Economic Security Act CARES Act it allowed employers to defer the deposit and payment of the employers share of Social Security taxes from March 27 2020 to December 31 2020. Self-employed individuals need to take the Medicare and Social Security amounts from the calculator and subtract it from net income to obtain an accurate number.

Generally speaking however SUTA oscillates between 27 and 34. New changes to payroll taxes in 2020 to 2021. The FUTA tax liability is based on 17600 of employee earnings 4900 5700 7000.

File this form annually. Amounts Returned State and Federal Tax PublicationsForms and Contacts. It fits perfectly in line for business startups that need something legit in place but dont need larger more complicated payroll platforms.

Use ClockSharks free labor burden calculator to help you accurately calculate what your labor burden is. Use this calculator to quickly calculate payroll yourself. How to Calculate Payroll Taxes with Gusto.

File this form with the Social Security Administration annually. So far 2020 has proved to be a tumultuous year especially for business owners. The SUTA program was developed in each state in 1939 during the Great Depression when the US.

As long as you pay your state unemployment taxes each year your business is eligible for a tax credit of up to 54 to offset the 6 tax you pay into FUTA. Kerzdenn Kowalchuk Vizeer Services LLC As part of an entrepreneurship network Im always searching for platforms that are ideal for startups. Form 1096 reports the dollars you paid to independent contractors using 1099 forms.

What Is the Onboarding Process for a New Employee.

Futa Tax Overview How It Works How To Calculate

Formulate If Statement To Calculate Futa Wages Microsoft Community

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

Solved Calculation Of Taxable Earnings And Employer Payroll Taxes And Preparation Of Journal Entry Selected Information From The Payroll Register O Course Hero

Need An Excel Formula To Calculate Suta Tax On Monthly Wages With A Microsoft Community

Payroll Tax Calculator For Employers Gusto

Need An Excel Formula To Calculate Suta Tax On Monthly Wages With A Microsoft Community

Solved Instructions Calculation And Journal Entry For Chegg Com

Calculating Futa And Suta Youtube

What Is The Federal Unemployment Tax Futa Cleverism

How To Calculate Unemployment Tax Futa Dummies

Calculating Suta Tax Youtube

Solved Calculate Employer S Total Futa And Suta Tax As Tclh Chegg Com

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Solved Calculation Of Taxable Earnings And Employer Payroll Taxes Chegg Com